Windows Phone is still gaining ground despite increased competition from new OS launches in the last quarter according to analytics firm Kantar’s latest numbers obtained via WMPowerUser. These gains are coming largely at the expense of BlackBerry, who lost 3 million subscribers last quarter according to its most recent earnings report.

Practically every major market has seen growth by Windows Phone 8, which is continuing to erode the numbers of its competitors. WP8 grew from 6.2 percent to 6.7 percent in the UK alone in only one month, more than doubling its market share in the region in the past year. At the same time, BlackBerry dropped dramatically from 16.8 percent to only 5.1 percent in the last year. This effectively drops BlackBerry out of third place in the region and gives WP8 a comfortable edge.

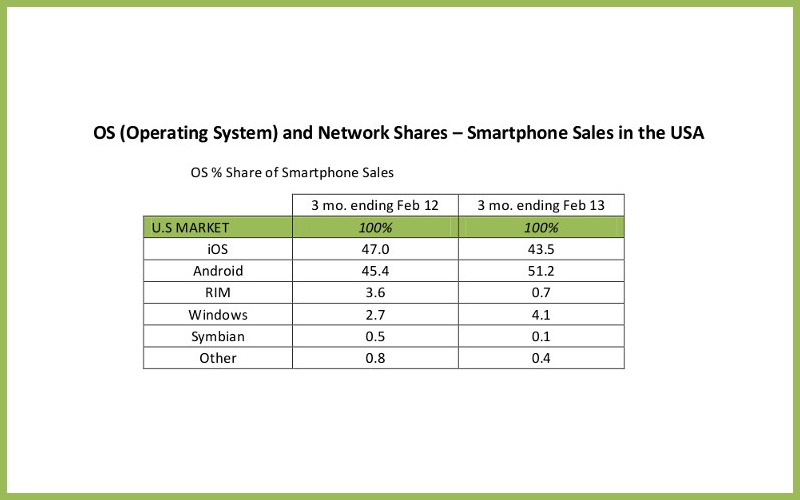

In Italy, it’s most successful turnaround market, WP8 climbed from 5.4 percent to 13.1 percent of sales in just one year. The United States is also seeing significant growth for the OS.

While WP8 grows, both Symbian and BlackBerry continue to feel the pressure as their numbers dropped across the board, the biggest drop being seen in Mexico for both platforms.

“Consumers just don’t have the same levels of pent up demand for the [z10] as they did for the iPhone 5.”

“The launch of the BlackBerry Z10 has not resulted in an immediate turn around for the Canadian company in Great Britain,” said Kantar WorldPanel ComTech, Dominic Sunnebo. “Although the new model received great reviews, it’s going to take time for BlackBerry to see share gains. Consumers just don’t have the same levels of pent up demand for the handset as they did for the iPhone 5.

“Over the past few years it has been BlackBerry’s budget devices, like the Curve 8520 and 9320, which have been selling well and these attract a young, price sensitive consumer. The Z10 is a high-end handset with a price to match, so going after its existing base of consumers will require a significant trade up. The handset is likely to start selling in more serious numbers once the launch price falls, and BlackBerry 10 in general, when the range is padded out with a number of wallet-friendly mid-range offerings.”

Apple and Android continue to hold their positions at the top of the anthill, but there’s no telling what can change as the smartphone market continues to expand.